AUD/JPY Price Analysis: On the back foot below 100-hour EMA

- AUD/JPY struggles to find direction after Monday’s slump, improved recently.

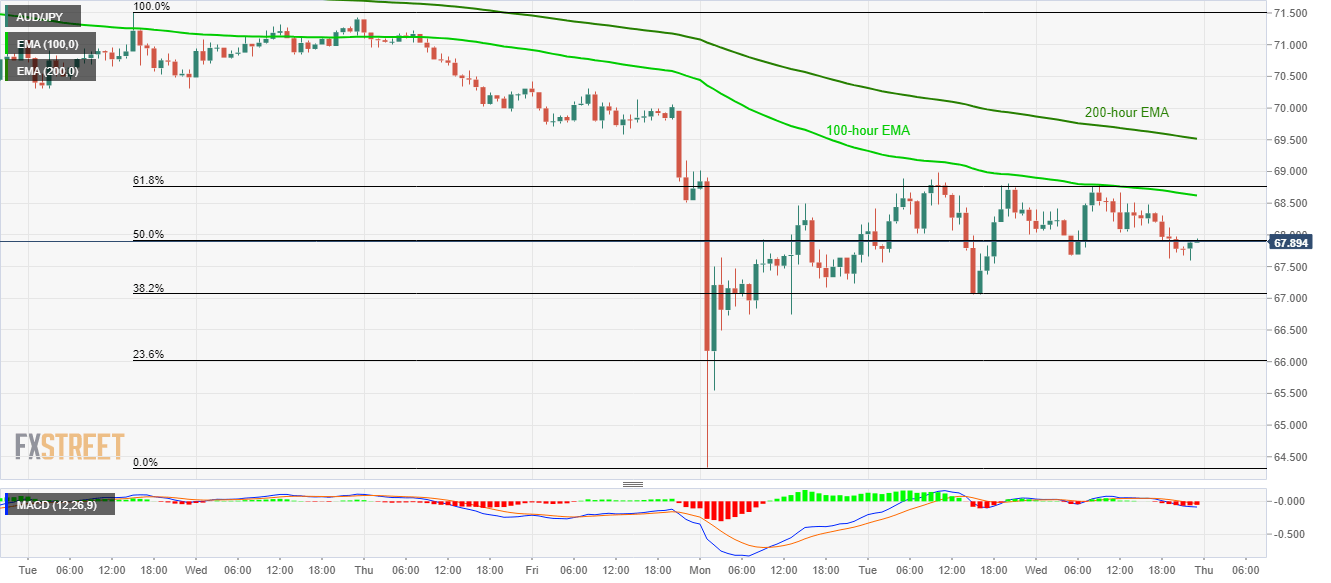

- 61.8% Fibonacci retracement adds to the upside barrier amid bearish MACD.

- Sellers will wait for a sustained break below 38.2% Fibonacci retracement.

AUD/JPY registers 0.18% gains to 67.90 amid the initial Thursday morning in Asia. The pair recently bounced off 67.60 but stays below the key resistances.

Among them, 100-hour EMA and 61.8% Fibonacci retracement of the early-month fall, around 68.60 and 68.75 respectively, are likely nearby upside barriers that can challenge the recent pullback.

Should buyers manage to dominate past-68.75, 200-hour EMA and the lows marked during the previous week, near 69.50/55, should gain the market attention.

On the downside, 38.2% Fibonacci retracement level of 67.00 remains in the spotlight as a clear break below the same could gradually recall the early-week lows surrounding 64.30.

However, intermediate halts during the fall close to 66.70 and 65.80 can’t be ruled out.

AUD/JPY hourly chart

Trend: Bearish