Back

24 Jan 2020

Gold Futures: Extra gains in the pipeline

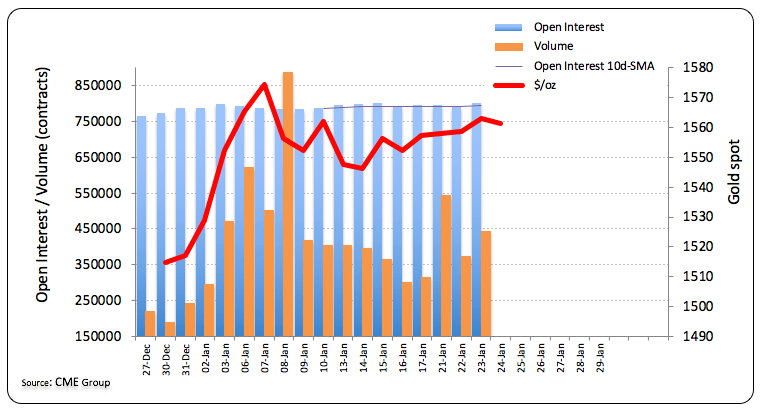

Traders added almost 10.5K contracts to their open interest positions on Thursday, reversing two drops in a row, as per advanced prints from CME Group. In the same direction, volume partially offset the previous drop and increased by around 70.5K contracts.

Gold expected to move higher on safe haven demand

News from the Wuhan coronavirus continues to drive the price action in the ounce troy of Gold, at least in the very near-term. Thursday’s uptick was reinforced by open interest and volume, leaving the scenario ripe for the continuation of the upside.